When you take a pill for high blood pressure, diabetes, or an infection, there’s a good chance the active ingredient inside came from a factory in China. By 2023, Chinese manufacturers supplied 80% of the world’s active pharmaceutical ingredients (APIs) - the raw chemical building blocks that make generic drugs work. But behind that massive scale lies a growing tension: China dominates production, but quality remains a serious concern for regulators, pharmacies, and patients alike.

How China Became the World’s Pharmacy

China didn’t become the top API producer overnight. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, offering tax breaks, and relaxing environmental rules to attract investment. By 2015, China had over 7,000 drug manufacturers. Today, that number is down to about 2,500 - not because the industry shrank, but because the government cracked down on low-quality plants. The 2016 Generic Consistency Evaluation (GCE) program forced factories to prove their generic drugs performed the same as brand-name versions. Only 35% of generics have passed this test so far, but the pressure is real.Chinese factories now churn out massive volumes. Companies like Sinopharm and Shijiazhuang Pharma Group can produce 500 to 2,000 metric tons of a single API per year. That’s enough to fill millions of pills. Their secret? Vertical control. They own the supply chain from raw chemicals to finished API, cutting out middlemen and slashing costs. A kilogram of API made in China costs $50-$150. The same thing made in the U.S. or Europe? $200-$400. That price gap is why 88% of the APIs used in American medicines come from overseas - and nearly 30% of those come from China.

Where Quality Breaks Down

Cost savings don’t always mean better medicine. The U.S. Food and Drug Administration (FDA) has issued warning letters to Chinese manufacturers for the same problems, year after year. In inspections between 2022 and 2023, 78% of facilities failed to meet basic lab controls. That means they couldn’t prove their drugs contained the right amount of active ingredient. Sixty-five percent didn’t properly validate their manufacturing processes. And 52% had data integrity issues - records were altered, deleted, or never recorded in the first place.One of the biggest red flags? Batch processing. While U.S. and European plants increasingly use continuous manufacturing - a modern, real-time method that reduces errors - 65% of Chinese API production still relies on old-school batch methods. These involve large vats, manual transfers, and long wait times between steps. More steps mean more chances for contamination or inconsistency. A 2023 FDA study found that 12.7% of Chinese API samples failed purity tests. For European APIs, it was 2.3%. For U.S.-made, just 1.8%.

And it’s not just about the chemistry. Documentation is a nightmare. A 2023 PhRMA survey found 37% of U.S. drugmakers had experienced falsified paperwork from Chinese suppliers. One company, Zydus Pharmaceuticals, recalled 1.2 million bottles of blood pressure medication in 2023 because the API from China’s Huahai Pharmaceutical had too little active ingredient. Patients didn’t get the dose they needed. That’s not a small mistake - it’s a safety risk.

The Indian Middleman

Here’s something most people don’t realize: India makes most of the finished pills you buy at the pharmacy. But India doesn’t make most of the API. It imports 65% of its raw ingredients from China. That creates a dangerous chain. If China cuts off supply - whether due to trade war, pandemic, or factory shutdown - India can’t make pills. And if India can’t make pills, the U.S. and Europe feel it fast.China dominates the first half of the supply chain - the dirty, dangerous, chemical-heavy steps like fluorination and synthesis using toxic solvents. India and Western companies handle the final formulation, packaging, and quality checks. But if the raw material is flawed, no amount of final testing can fix it. This dependency is why experts like Dr. Andrew von Eschenbach call China’s control over key starting materials a “national security vulnerability.”

What’s Being Done - and What’s Not

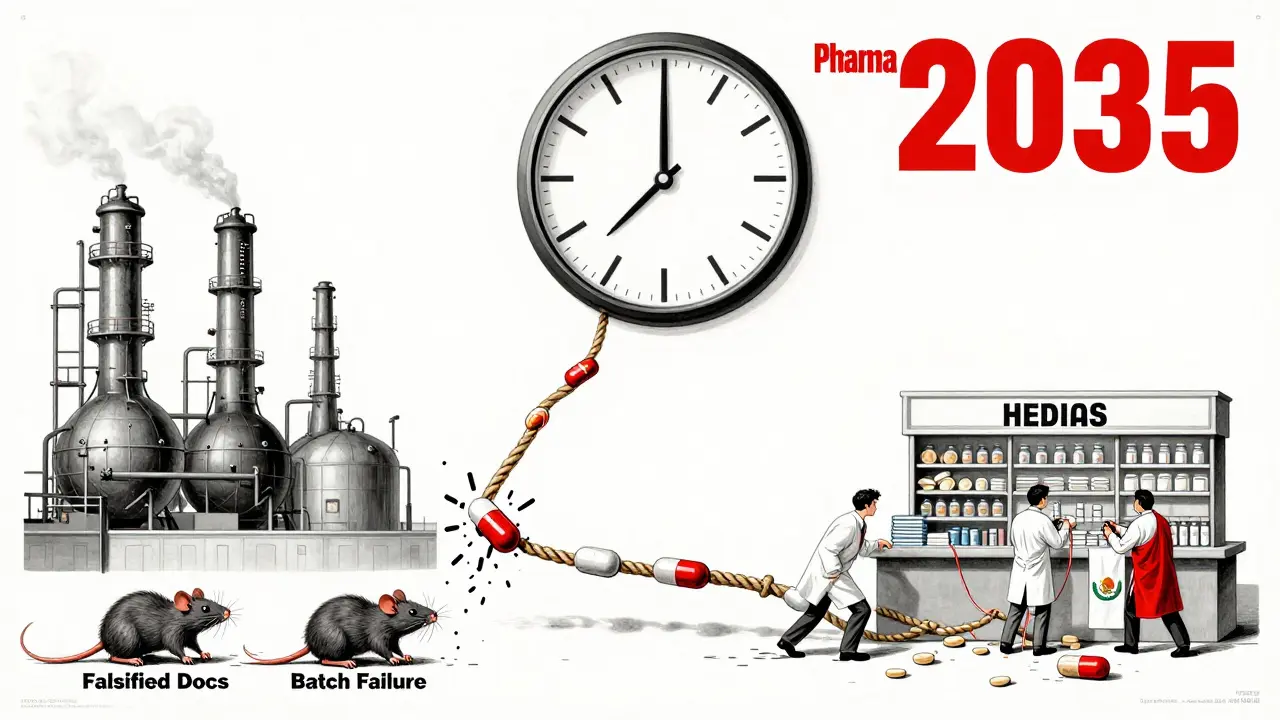

China claims it’s cleaning up. Since 2015, it shut down 80% of non-compliant factories. It now requires 95% of its GMP-certified plants to follow international standards. The NMPA (China’s drug regulator) says it’s aligned with the ICH Q7 guidelines. But the numbers tell a different story. Only 187 Chinese API facilities have been inspected by the FDA as of 2023. The FDA inspects its own domestic plants 10 times more often. Why? Access. Chinese authorities restrict how often and how deeply foreign inspectors can dig into facilities.Meanwhile, China’s own quality push is slow. The GCE program has only covered 35% of generics. The rest? Still on the market without proof they work the same as the original. And while China’s 2024 “Pharma 2035” plan promises $22 billion to upgrade technology and adopt continuous manufacturing, that’s a long-term game. By 2026, only 30% of high-volume products are supposed to shift to modern methods. That’s barely a start.

Real-World Impact: Who’s Feeling the Pain?

Pharmacists and quality control teams on the front lines are seeing it firsthand. A quality assurance specialist on Reddit, posting under “QA_PharmD,” said they had to retest 37% of Chinese-sourced metformin API for out-of-spec results - compared to just 8% for Indian-sourced material. Another user, “SupplyChainPro,” admitted their company saved $4.2 million a year switching to Chinese API for amoxicillin - but accepted a 15% higher rejection rate. That’s the trade-off: cheaper pills, more waste, more risk.McKinsey and Gartner both found Chinese suppliers score highest on price and capacity - but lowest on quality consistency. They average 3.2 out of 5 for reliability. European suppliers? 4.1. That gap matters when you’re responsible for millions of patients. One U.S. generic manufacturer told a 2023 PwC survey that cultural differences in documentation made compliance take 18-24 months longer than expected. Some Chinese factories didn’t understand why daily logbooks or electronic records were so important. In the U.S., that’s basic. In China, it was seen as extra work.

The Global Push to Diversify

Governments are waking up. The U.S. passed the CHIPS and Science Act, allocating $500 million to build domestic API capacity. The European Union wants to cut its reliance on Chinese APIs from 80% to 40% by 2030. India is expanding its own API production, though it still depends on China for 65% of its raw materials. Vietnam and Mexico are stepping in, too, offering lower costs than the U.S. and better regulatory transparency than China.But replacing China’s scale is nearly impossible. No other country can produce 2,000 metric tons of a single API at $50 a kilogram. The infrastructure, chemical supply chains, and labor costs are unmatched. Even if China’s market share drops from 78% to 65% by 2030, as McKinsey predicts, it will still be the biggest supplier by far.

What This Means for You

You might not care where your pills are made - as long as they work. But here’s the truth: if you’re taking a generic drug, especially for chronic conditions like diabetes, heart disease, or high blood pressure, you’re relying on a supply chain that’s fragile, opaque, and sometimes unreliable. The FDA can’t inspect every Chinese plant. The NMPA can’t force every factory to follow the rules. And when a batch fails, it doesn’t always get recalled right away.That doesn’t mean all Chinese-made generics are dangerous. Many are safe, effective, and life-saving. But the system is built on volume, not verification. The companies that invest in quality - like Pfizer’s joint venture with Zhejiang Huahai, which took 36 months and $22 million to get FDA approval - are the exception, not the rule.

If you’re a patient, ask your pharmacist: “Where is this generic made?” If you’re a healthcare provider, demand transparency from your suppliers. If you’re a policymaker, support efforts to diversify supply chains and fund independent testing. The cost of cheap medicine isn’t just financial - it’s measured in patient safety.

What’s Next?

China’s next big test is whether it can turn its reputation around. Right now, the world trusts it for price, not purity. If China wants to keep its dominance, it needs to fix the gaps - not just in regulations, but in culture. It needs to stop treating documentation as a formality and start treating it as a lifeline. It needs to stop seeing FDA inspections as an intrusion and start seeing them as a partnership.Until then, the world will keep buying Chinese APIs - because there’s no real alternative. But we’ll also keep watching, testing, and waiting for the next recall.

Comments

Lisa Rodriguez February 1, 2026 at 14:45

So I work in pharmacy tech and we get Chinese-sourced metformin all the time. Sometimes the pills look different, sometimes they crumble. We don't always know why but we just keep dispensing. I wish we had more transparency but honestly? Most patients don't care as long as it's cheap. I just hope someone's checking the batches.

That one recall last year? Yeah, that scared me. I had a diabetic patient who went into hypoglycemia because the dose was off. Turned out it was from the same batch as the recall. We didn't know until weeks later.

Chris & Kara Cutler February 2, 2026 at 18:47

China makes the world’s meds 🌍💊 but we act like we’re shocked when things go wrong? We’ve been outsourcing for decades. If we wanted safe, we’d pay more. Simple.

Also… I’m not mad. I’m just disappointed. 😔

Donna Macaranas February 4, 2026 at 02:06

I’ve read through this whole thing and I’m just… tired. Not angry, not shocked. Just tired. It’s like we all know this is broken but nobody’s willing to fix it because it’s too expensive or too complicated. We want our pills cheap, our phones cheap, our clothes cheap. Guess what? The system reflects that.

I don’t have a solution. I just wish we’d stop pretending this isn’t a problem.

Aditya Gupta February 5, 2026 at 14:19

As an Indian pharma guy, I see this daily. We import 65% of our API from China. We test, we check, we retest. But when the base material is bad? No amount of QA fixes it. We’re stuck in the middle. We want to make good meds, but our hands are tied by cost and supply.

India’s trying to build its own capacity, but it takes time, money, and trust. And right now? Trust is in short supply.

Lu Gao February 7, 2026 at 00:26

Wait, hold on. You’re saying we’re worried about Chinese API quality… but you completely ignored the fact that the FDA approved 90% of those same facilities? If they were that dangerous, wouldn’t the FDA shut them down? Also, the 12.7% failure rate? That’s still better than some U.S. plants in the 90s.

Stop fearmongering. The real issue is that Big Pharma doesn’t want to pay more. That’s it.

Angel Fitzpatrick February 8, 2026 at 14:58

Let’s be real here. This isn’t about quality control. It’s about bioweapons. 🧬

China’s been flooding the global drug supply with substandard APIs for over a decade - not because they’re lazy, but because they’re *training* us to be dependent. Think about it: if they cut off supply during a crisis, we’re helpless. That’s not capitalism. That’s strategic sabotage.

And don’t tell me about ‘GMP certifications’ - those are just paper trophies. The NMPA and the PLA have ties. You think they’re inspecting labs or just taking bribes? I’ve seen the documents. They’re not even trying.

This is why I stockpile my meds. And why I’m buying land in New Zealand. They don’t even use Chinese API there. I’m not paranoid. I’m prepared.

Jamie Allan Brown February 8, 2026 at 21:57

I’ve worked with both European and Chinese suppliers over the last 15 years. The Chinese ones are faster, cheaper, and often just as good - if you pick the right partner. The problem isn’t China. It’s that we treat all suppliers the same. We don’t vet. We don’t build relationships. We just order the lowest bid.

There are excellent Chinese manufacturers. And there are terrible ones. Just like everywhere else.

Maybe instead of blaming a whole country, we should demand better auditing, longer contracts, and more transparency. Not panic.

Nicki Aries February 10, 2026 at 10:19

And yet… we keep buying. We keep signing contracts. We keep telling ourselves, “It’s fine, they passed inspection.” But the inspections are scheduled. The logs are edited. The vats are cleaned right before the audit. And the patient? They just take the pill. And hope.

I’ve seen the spreadsheets. The rejection rates. The cost savings. And the quiet panic in the QA department when the batch fails again. We’re not just cutting corners. We’re betting lives on a gamble.

It’s not that we don’t know. It’s that we’ve learned to live with the knowing.

And that’s the real tragedy.